Key Financial Ratios Often Reveal the Difference Between Successful and Bankrupt Companies

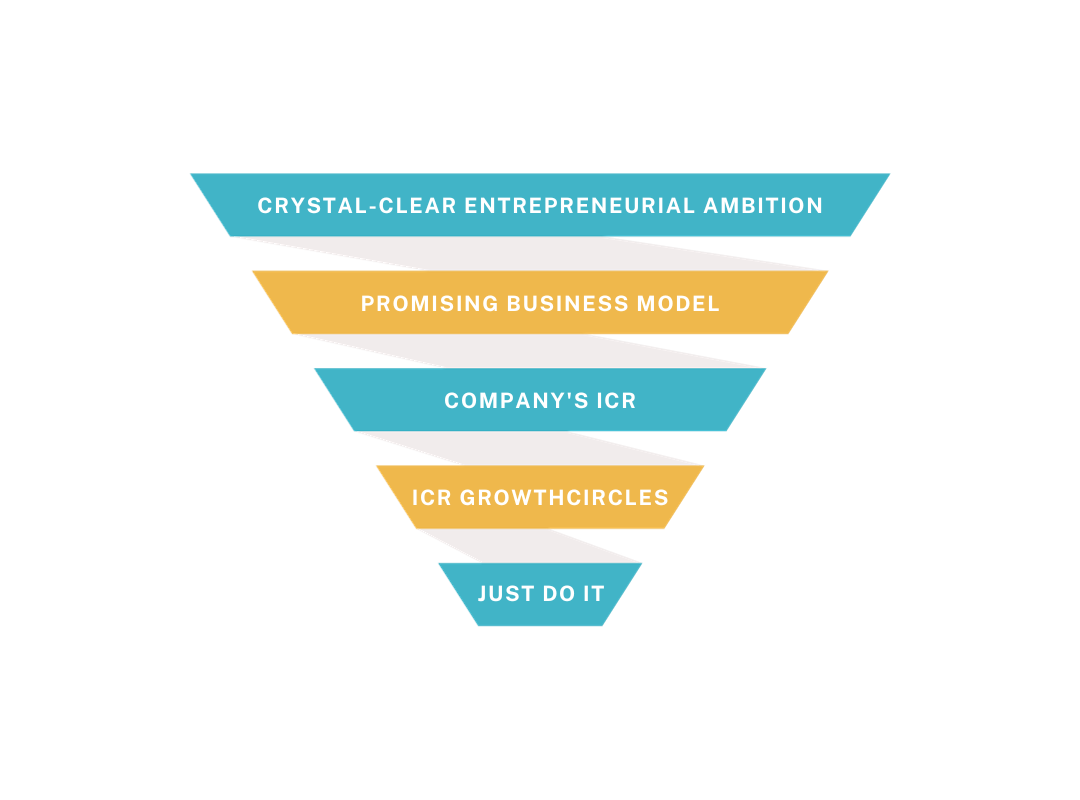

For most small and medium-sized enterprises (SMEs), governance is something far away. In other words, measures of good governance are not yet part of daily practice. Particularly explosive growth and/or external demands, for example from an external financier, have changed this to date. Especially to make the likelihood and impact of risks manageable. Oddly enough, because fundamentally every entrepreneur wants to be successful and certainly not fail. Thus, corporate governance aimed at SMEs is actually relevant for every entrepreneur: it is about having control over realizing entrepreneurial ambition. And there's quite a lot involved. Therefore, we will be paying ample attention to this unexplored area in the world of the entrepreneur in the coming period.

Today, Route ICR shares the fifteenth article from the series 'How to practically implement SME governance'.

Key Financial Ratios Often Reveal the Difference Between Successful and Bankrupt Companies

Amsterdam, March 23, 2022 - Entrepreneurship is simple. However, the hardest part is to undertake business simply. But why is that? Let's discuss this in the coming period. We will also look at how this problem can be solved. Today, Route ICR shares the fifteenth article from the series 'Implementing SME Governance in Practice'.

Knowing and understanding the main financial ratios and figures of your company has often been neglected. On one hand, it's understandable since it's not as exciting as landing a big deal. But on the other hand, it could very well be the difference between a successful and a bankrupt company. Therefore, entrepreneurs with serious ambitions must comprehend and internalize the key ratios and figures of their business. If you thoroughly understand how your key ratios behave, it can have significant predictive value.

Making Better Decisions Creates Peace of Mind

Key ratios and figures provide quick insight into your current position. Consider the answers to various questions. How profitable is your company? What is the profitability of your customers? Does your company need financing? How much risk does your business face in encountering difficulties or even bankruptcy? Or suppose you want to increase production by 20%. What does this mean for the capacity you need to employ? What cost structure is associated with it? Is your company logistically capable of implementing this change? What costs are involved? The key ratios of your company help to answer these questions. This enables you to make better decisions, leading to peace of mind.

Predicting the (Financial) Future

In practice, numerous questions and situations arise. For all the corresponding scenarios, it's comforting to know the financial implications. Determine where you want to end up. You do this for your company's vision, strategic objectives, and the translation of these goals into figures. So, you create a tight financial plan. Because fundamentally, as an entrepreneur, you want to create value. Following the key ratios and figures of your company provides insights that are actionable, or even necessary. This helps you better predict the financial future of your business. And that's exactly what creates the peace of mind every entrepreneur seeks. This aspect of implementing SME governance is crucial to becoming a better entrepreneur.