What is pre-financing?

Master Your Purpose. Own Your Freedom. With ICR.

One example of pre-financing is keeping products in stock so you can deliver quickly. Before receiving payment from your customers, you need funds to pay for and finance this inventory.

Another form of pre-financing is the payment terms you offer your customers (debtors). Your customers can take more or less time to pay the amount owed to your organization based on your company's policy. The reverse applies to your suppliers (creditors).

Pre-financing can be vital for organizations. It enables them to maintain their daily operations and keep running smoothly, even if there are temporary cash flow issues. This ensures operational continuity and prevents business interruptions.

Through pre-financing, organizations can invest in growth and expansion initiatives, such as launching new products, entering new markets, or expanding their production capacity. This can lead to increased market share and improved competitive position.

Pre-financing also provides organizations with financial flexibility to quickly respond to opportunities or challenges in the market. It allows them to react swiftly to changes in demand or take advantage of favorable purchasing opportunities.

Having sufficient pre-financing allows organizations to better manage risks. They can build reserves for unforeseen circumstances, such as economic downturns, natural disasters, or supply chain disruptions. An organization's ability to meet its obligations and successfully maintain its operations is often seen as a sign of financial health. Sufficient pre-financing can increase the confidence of stakeholders, such as investors, creditors, and customers.

In summary, pre-financing is crucial for organizations to ensure their growth, stability, and resilience in a dynamic and competitive environment.

Sustainable success through controlled and manageable growth

The ICR Growth & Success SaaS Platform helps people and organizations find balance and peace, through controlled and manageable growth, with the aim of a healthy and sustainably successful organization. We do this through the all-encompassing ICR Cycle.

Being inControl in this process from ambition to result is crucial. Within the ICR Cycle, inControl actually means controlled and manageable growth. The dashboard gives you insight into the current status. In the video below you can see how the dashboard transforms from the moment you start using ICR.

With our 4 ICR subscription options, you can decide for yourself when to fully engage with the entire ICR Cycle. Choose our successful approach and start your process 'from ambition to result' with the more than affordable ICR Ambition Refresher subscription.

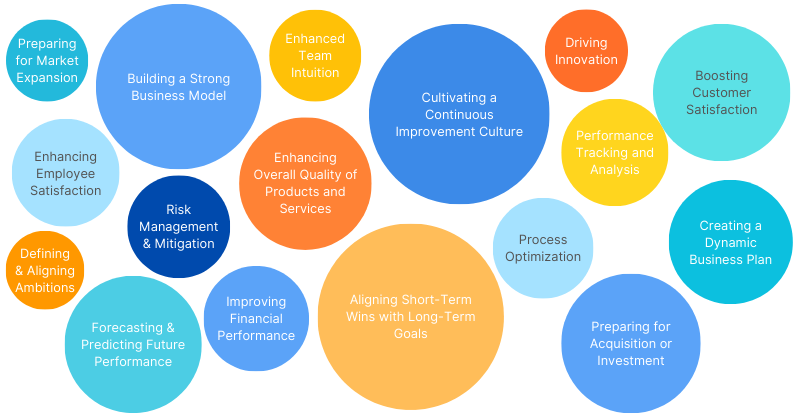

General applications of the ICR Growth & Success SaaS Platform

The ICR Growth & Success SaaS Platform addresses a wide range of business needs, making it a versatile tool for organizations striving for sustainable success. Below is an overview of its general applications, along with the added value it provides for businesses and organizations.

Learn more about the general applications of the ICR Growth & Success SaaS platform.