What is financing?

Master Your Purpose. Own Your Freedom. With ICR.

Financing refers to the process of obtaining money or capital to fund a specific project, business, or activity. In other words, it is the method by which you attract financial resources to pay for activities and make investments. It can take various forms, such as loans, investments, grants, equity, or other financial resources used to cover costs or stimulate growth.

The purpose of financing is often to provide the necessary resources to realize an initiative or keep a business operational. Financial resources refer to the availability of money. These resources are needed to enable capacity utilization, purchase raw materials, and so on. The need for these resources partly varies with the scale of activities but also follows a fixed pattern.

Through your company’s cash flow, you gain insight into the different cash streams and, more importantly, how you can influence them. This is crucial to ensure that there are always sufficient financial resources to meet your obligations.

Do not forget the importance of a 12-month rolling forecast. This prediction provides insight into how your organization’s activities will develop over the next 12 months and guides the associated figures, including operating profit (EBIT) and cash flow.

Financing enables organizations to grow and expand. It can be used for investments in new products, technologies, markets, or for increasing production capacity. Organizations also need financing to support their daily operations, such as paying salaries, buying raw materials, and covering other operational costs.

Financing plays a crucial role in stimulating innovation within organizations. It allows them to fund research and development, explore new ideas, and develop new products or services. Additionally, financing can be used to manage risks by building reserves for unforeseen circumstances, such as economic downturns or changes in market dynamics.

Organizations with adequate financing can be more competitive in the market. They can invest in marketing, branding, and customer service to strengthen their position relative to competitors. Furthermore, financing enables organizations to maintain a healthy capital structure, finding the right balance between equity and debt to support their growth without jeopardizing their financial stability.

In summary, financing is vital for organizations as it enables them to grow, innovate, manage risks, and remain competitive in their respective markets.

Sustainable success through controlled and manageable growth

The ICR Growth & Success SaaS Platform helps people and organizations find balance and peace, through controlled and manageable growth, with the aim of a healthy and sustainably successful organization. We do this through the all-encompassing ICR Cycle.

Being inControl in this process from ambition to result is crucial. Within the ICR Cycle, inControl actually means controlled and manageable growth. The dashboard gives you insight into the current status. In the video below you can see how the dashboard transforms from the moment you start using ICR.

With our 4 ICR subscription options, you can decide for yourself when to fully engage with the entire ICR Cycle. Choose our successful approach and start your process 'from ambition to result' with the more than affordable ICR Ambition Refresher subscription.

General applications of the ICR Growth & Success SaaS Platform

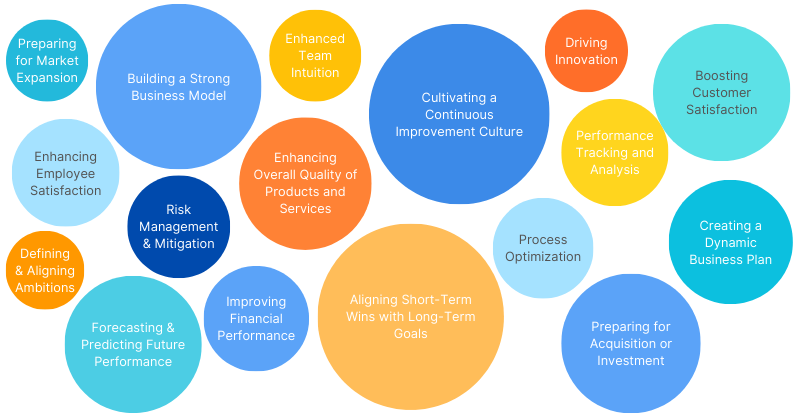

The ICR Growth & Success SaaS Platform addresses a wide range of business needs, making it a versatile tool for organizations striving for sustainable success. Below is an overview of its general applications, along with the added value it provides for businesses and organizations.

Learn more about the general applications of the ICR Growth & Success SaaS platform.