What is a financial plan?

Master Your Purpose. Own Your Freedom. With ICR.

A financial plan provides a financial translation of the vision and strategic goals, along with the methods for achieving them. It also establishes the milestones to be reached over time. Essentially, it determines the financial impact of the entire business plan. Typically, you make assumptions that are as well-founded as possible to ensure the financial plan approximates the (expected) reality.

The financial plan, in other words, serves as a roadmap for how your organization intends to manage and allocate its financial resources to achieve its vision and strategic goals. Thus, it addresses a core need within your organization's business model.

Your organization's financial plan typically includes the following components:

The operating budget outlines the expected revenues and expenses for a specific period. It calculates whether your business will be able to generate a profit. Ideally, this is done for at least one year, but preferably for several years. This helps management plan how much money will come in and where it will be spent.

The cash flow forecast is an overview of expected expenditures and revenues over a specific period. It shows how cash flows in and out of your organization. This way, you can see if there are sufficient financial resources available to meet all payment obligations during each period.

The investment plan specifies planned investments necessary to run your business, such as investments in assets like buildings, equipment, or technology. It also includes investments in inventory and other resources to get business processes going. The plan shows how these investments will be financed and what the expected returns are.

The financing strategy outlines the strategies for obtaining financing through loans, equity, grants, or other means. Choices must be made between own funds (equity) and loans (debt). The plan also describes the terms (repayment and such), including the costs of these financings.

The financial plan includes an evaluation of the financial risks your organization faces, such as market fluctuations or credit risks, and the strategies to manage or minimize these risks.

Additionally, the financial plan specifies the specific, measurable financial goals your organization aims to achieve within a certain timeframe. This could include the target value of your company within 3 to 5 years, and derived financial goals such as the brand value, the value of the customer portfolio, the value of real estate owned by your organization, etc. It also encompasses goals related to profit growth, cost reduction, or improvement of the capital structure.

The financial plan is indispensable for the effective management of financial resources and supports the overall strategic planning of your organization. It also provides crucial information for stakeholders such as investors, creditors, and management to make informed decisions.

Sustainable success through controlled and manageable growth

The ICR Growth & Success SaaS Platform helps people and organizations find balance and peace, through controlled and manageable growth, with the aim of a healthy and sustainably successful organization. We do this through the all-encompassing ICR Cycle.

Being inControl in this process from ambition to result is crucial. Within the ICR Cycle, inControl actually means controlled and manageable growth. The dashboard gives you insight into the current status. In the video below you can see how the dashboard transforms from the moment you start using ICR.

With our 4 ICR subscription options, you can decide for yourself when to fully engage with the entire ICR Cycle. Choose our successful approach and start your process 'from ambition to result' with the more than affordable ICR Ambition Refresher subscription.

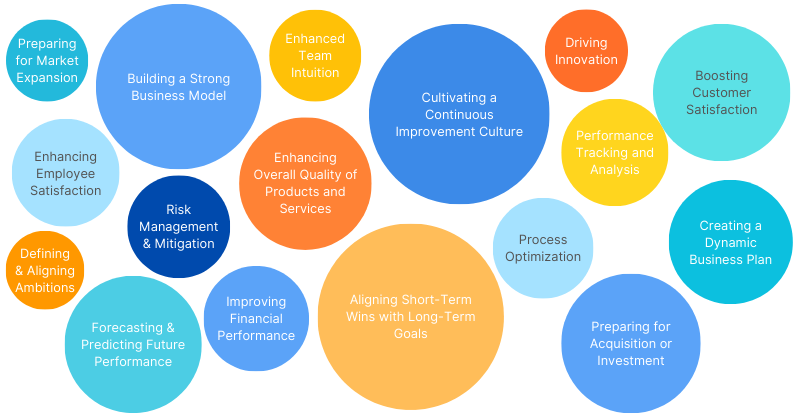

General applications of the ICR Growth & Success SaaS Platform

The ICR Growth & Success SaaS Platform addresses a wide range of business needs, making it a versatile tool for organizations striving for sustainable success. Below is an overview of its general applications, along with the added value it provides for businesses and organizations.

Learn more about the general applications of the ICR Growth & Success SaaS platform.