What is depreciation?

Master Your Purpose. Own Your Freedom. With ICR.

Depreciation is an accounting process in which the cost of a durable asset (such as machinery, buildings, vehicles, or equipment) is spread over its useful life. This means that the investment costs of assets are not recorded as expenses all at once but are instead gradually depreciated over several years.

Depreciation ensures that the costs of an investment are evenly distributed over the period during which the asset is used. This prevents a large investment from immediately appearing as an expense on the balance sheet, which could negatively impact the financial results of an organization.

Depreciation, therefore, allows for a more accurate representation of the value of assets in the accounting records. As a machine ages and wears out, its value decreases. In the bookkeeping, this is reflected by a decrease in the book value through depreciation, providing a realistic representation of the value of assets on the balance sheet.

Depreciation also enables organizations to better plan for the replacement costs of assets. As a machine or other asset approaches the end of its useful life, the organization can anticipate its replacement by closely monitoring depreciation in the accounting records.

In short, depreciation is essential for sound financial management and planning. It helps manage assets effectively and spread their costs over their useful life.

Sustainable success through controlled and manageable growth

The ICR Growth & Success SaaS Platform helps people and organizations find balance and peace, through controlled and manageable growth, with the aim of a healthy and sustainably successful organization. We do this through the all-encompassing ICR Cycle.

Being inControl in this process from ambition to result is crucial. Within the ICR Cycle, inControl actually means controlled and manageable growth. The dashboard gives you insight into the current status. In the video below you can see how the dashboard transforms from the moment you start using ICR.

With our 4 ICR subscription options, you can decide for yourself when to fully engage with the entire ICR Cycle. Choose our successful approach and start your process 'from ambition to result' with the more than affordable ICR Ambition Refresher subscription.

General applications of the ICR Growth & Success SaaS Platform

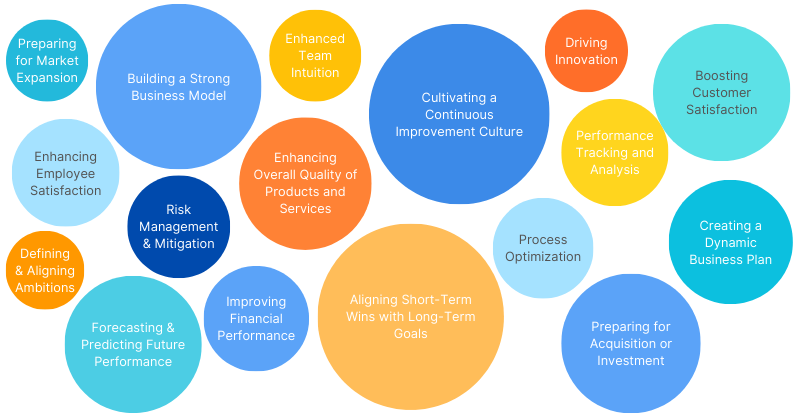

The ICR Growth & Success SaaS Platform addresses a wide range of business needs, making it a versatile tool for organizations striving for sustainable success. Below is an overview of its general applications, along with the added value it provides for businesses and organizations.

Learn more about the general applications of the ICR Growth & Success SaaS platform.