What is debt capital?

Master Your Purpose. Own Your Freedom. With ICR.

Debt capital, also known as external capital, refers to the money that an organization borrows from external parties to finance its activities. This can come from banks (for example, in the form of loans), suppliers (credit facilities), or investors (such as bonds). Debt capital differs from equity capital. Equity capital consists of the money that the owner(s) or shareholders have invested in the organization.

Many companies do not have enough equity capital to make (large) investments, such as purchasing new machinery, expanding production capacity, or developing new products. Debt capital provides the opportunity to make these investments without having to issue new shares immediately.

By using debt capital instead of attracting new shareholders, as an entrepreneur, you retain control over your company. With a loan, the lender typically has no control over the daily operations, unlike new shareholders. Unless otherwise agreed.

A good balance between equity and debt capital means that there is an optimal capital structure. This keeps financing costs as low as possible while ensuring the organization's flexibility. The interest that an organization pays on loans is often tax-deductible. This means that using debt capital can provide tax benefits, making it more advantageous in certain situations compared to equity financing.

So, while debt capital offers various advantages, it also carries risks, such as interest payments and the obligation to repay debts, regardless of the company's financial results or health. It is therefore extremely important for an organization to handle the acquisition and management of debt capital carefully to maintain a healthy financial foundation.

Sustainable success through controlled and manageable growth

The ICR Growth & Success SaaS Platform helps people and organizations find balance and peace, through controlled and manageable growth, with the aim of a healthy and sustainably successful organization. We do this through the all-encompassing ICR Cycle.

Being inControl in this process from ambition to result is crucial. Within the ICR Cycle, inControl actually means controlled and manageable growth. The dashboard gives you insight into the current status. In the video below you can see how the dashboard transforms from the moment you start using ICR.

With our 4 ICR subscription options, you can decide for yourself when to fully engage with the entire ICR Cycle. Choose our successful approach and start your process 'from ambition to result' with the more than affordable ICR Ambition Refresher subscription.

General applications of the ICR Growth & Success SaaS Platform

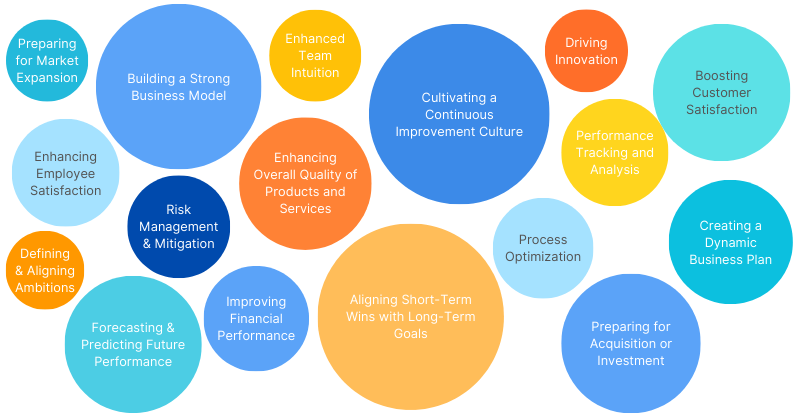

The ICR Growth & Success SaaS Platform addresses a wide range of business needs, making it a versatile tool for organizations striving for sustainable success. Below is an overview of its general applications, along with the added value it provides for businesses and organizations.

Learn more about the general applications of the ICR Growth & Success SaaS platform.