What is a closing process in administration?

Master Your Purpose. Own Your Freedom. With ICR.

The closing the books process is the procedure by which an organization finalizes and reports its financial records at the end of a financial period, such as a month, quarter, or year. During this process, all transactions for the given period are recorded, reviewed, and corrected to ensure that the financial data is accurate and complete.

This process results in the preparation of financial statements, such as the Balance Sheet, the Profit & Loss Accounts, and the Cash Flow Statement. In other words, closing the books refers to finalizing a financial period in the organization’s records. All transactions from the prior period are included to establish a new benchmark for financial figures.

The balance sheet reflects the financial position at the end of the period, while the income and expenses for the period are shown in the Profit & Loss Accounts. The cash flow is derived from the transactions that occurred during the period.

Formally closing the books ensures that all income, expenses, assets, and liabilities are accurately recorded, leading to reliable financial statements. These figures are used to assess the financial health of your organization. Many companies and organizations are required to submit periodic financial reports to regulatory bodies, and a properly executed closing process helps ensure compliance with these legal requirements.

The leadership of an organization must be able to rely on accurate financial data, especially to make informed strategic decisions. A well-executed closing process provides up-to-date and accurate information about the organization's performance and financial position. By closing the books on time, the organization is better equipped to plan and adjust budgets and forecasts based on the latest insights into financial results.

The closing process often involves a thorough review of financial and operational data. This helps ensure the accuracy of the figures and can also help identify accounting errors or suspicious transactions, which is important for maintaining the integrity of financial records.

Moreover, your organization will be better able to manage its cash flow when it has a clear view of its current financial situation. This is critical to ensure that there are sufficient liquid funds available to meet obligations.

In conclusion, the closing the books process is essential for transparency, financial health, and regulatory compliance. It enables your organization to generate accurate and timely financial reports, which are crucial for both internal and external stakeholders.

Sustainable success through controlled and manageable growth

The ICR Growth & Success SaaS Platform helps people and organizations find balance and peace, through controlled and manageable growth, with the aim of a healthy and sustainably successful organization. We do this through the all-encompassing ICR Cycle.

Being inControl in this process from ambition to result is crucial. Within the ICR Cycle, inControl actually means controlled and manageable growth. The dashboard gives you insight into the current status. In the video below you can see how the dashboard transforms from the moment you start using ICR.

With our 4 ICR subscription options, you can decide for yourself when to fully engage with the entire ICR Cycle. Choose our successful approach and start your process 'from ambition to result' with the more than affordable ICR Ambition Refresher subscription.

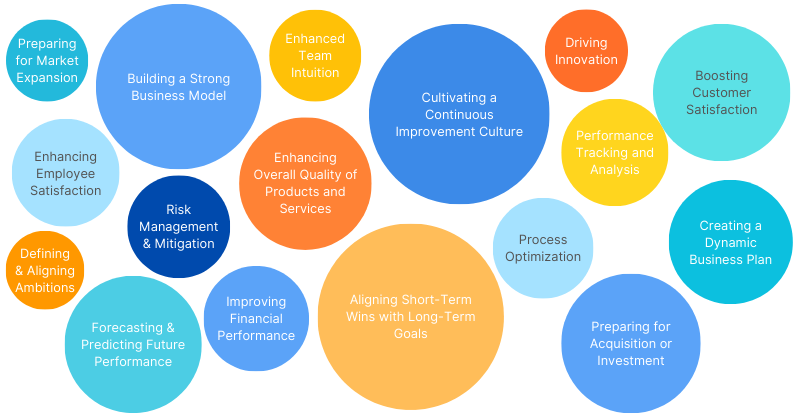

General applications of the ICR Growth & Success SaaS Platform

The ICR Growth & Success SaaS Platform addresses a wide range of business needs, making it a versatile tool for organizations striving for sustainable success. Below is an overview of its general applications, along with the added value it provides for businesses and organizations.

Learn more about the general applications of the ICR Growth & Success SaaS platform.